Home Equity – Impacting the Cost and Refinancing of Mortgages

Home Equity – The Basics

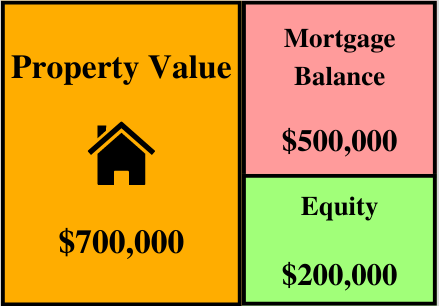

When talking about property, Equity refers to the amount of the property value that is owned by the home-owner. When purchasing property, equity is initially dependent on how much of your own cash you use and is then over time is affected by changes in the property value.

When property is bought fully with cash (no loan), home equity is the value of the property. Understanding home equity becomes more important when property has been bought with the help of a loan. When you purchase property with the help of a loan from the bank, your home equity is the property value minus the loan amount owed to the bank. The higher deposit a home-buyer puts on a property, the higher their equity will be.

Importance of Equity For A Home Loan

Below are the 3 main areas where equity is important for a home loan.

Equity determines how much interest the bank charges you on the debt./

When applying for a mortgage, the interest rate charged by the bank is dependent on how much equity the home buyer will have in the property. Higher home equity results in lower risk for the bank, hence they charge a lower interest rate on the loan amount, reducing the loan repayments the home-owner will have to make.

Equity determines your ability to refinance and cash-out.

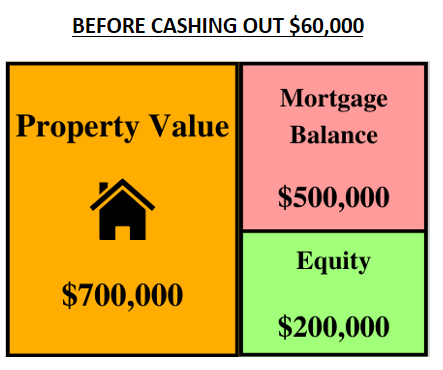

As seen by the surge of refinances in 2022, refinancing is a way for borrowers to reduce their loan repayments by moving to lenders offering more competitive rates. Generally banks will only allow refinances to their products if the owner’s equity in the property is over 20%.

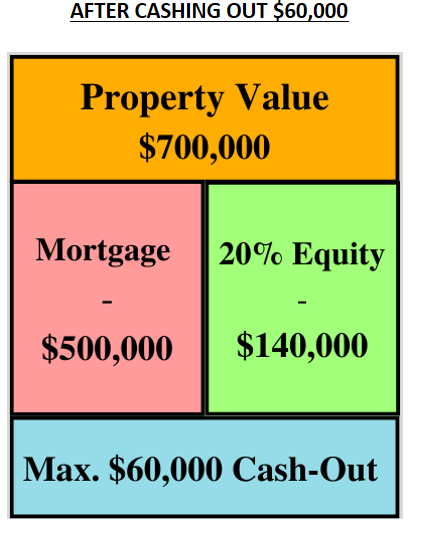

If a home-owner who has built up equity over a long period of time wishes to increases their mortgage balance to ‘cash-out’ for investments, property purchases, renovations etc, the maximum amount of cash they will be able to access is whatever amount takes their equity down to the 20% barrier.

Equity levels impact the fees banks charge when providing a loan.

Generally, banks prefer when the buyer owns minimum 20% equity in the home when they purchase property with a loan. If the buyer doesn’t have the cash for a 20% deposit, the bank will charge ‘Lenders Mortgage Insurance’ (LMI) fees which costs tens of thousands of dollars. This is because banks consider loans more risky when the home-owner has less ‘skin in the game’.

First Home Buyer Schemes remove LMI fees for purchases under 20% deposit.

Conclusion – Equity is your share of ownership in the property.

Equity is important to understand as it affects how much interest and fees are charged to the borrower as well as determines refinancing capacity of the borrower.

2022 has seen mortgage refinances hit record levels as home owners seek to reduce their rising loan repayments due to interest rate increases. Having sufficient home equity has allowed them to maximise their savings.

As property prices are expecting to continue falling into 2023, Making extra loan repayments when possible will help offset the effects that falling prices have on home equity.

Reach out to us if you have any questions or want to get the ball rolling with purchasing property or refinancing an existing mortgage!