Credit Scores – How Financial Behaviour Impacts Your Borrowing Capacity

Credit Scores – They’re the hidden numbers that constantly track our credit card behaviour, bank account balances, and loan repayments. These scores can go unnoticed for years until they are really required.

So what exactly do these scores mean and why are they important for people looking for home, car or personal loans?

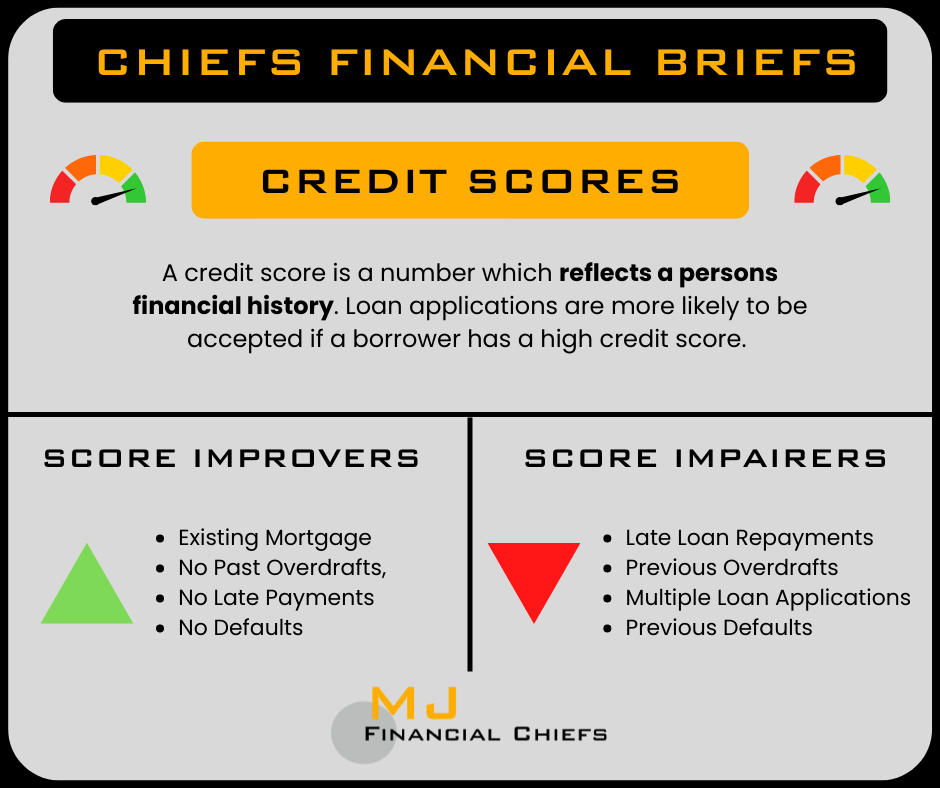

Essentially, Credit Scores are a way for banks, non-bank lenders and insurers to assess a borrowers level of risk. The higher the score, the better behaved a person has been financially, and the lower risk they pose to the bank. Lower risk generally means the borrower pays less in interest and fees.

Let’s now get to the vital information – What impairs a credit score and what improves it?

Credit Score Improvers:

Banks want to see that you are a good saver, pay bills on time and are not taking on too much debt. If you have the achievements below, you will have a good credit score, resulting in no red flags being shown to the banks.

- A good history of making on time loan repayments

- No previous bank account overdrafts

- No previous late repayments

- No previous loan defaults

- No unsecured debts

If you have previously gone over a credit card limit or went negative on your bank account, there are strategies you can implement to put your credit score back on the right track!

Tips to improve your credit score:

1. Bank Account Management:

Link your cheque (everyday) bank account with your savings account to ensure that if a bill or payment overdrafts your cheque account, your savings account will cover the difference, avoiding an overdraft being shown on your credit report.

Alternatively you can ask your bank to remove the overdraft facility, which will avoid you paying extra fees and interest in the event of overdraft. This action however will mean any payments or bills will be declined if they cause the balance to go below zero.

Good saving habits are always the key to maintaining a strong credit rating. As late loan repayments or bank overdrafts severely hurt credit scores, it is vital to have a ‘safety net’ of cash which can absorb any unexpected charges and prevent you falling into negative bank balances.

The Chiefs can assist if you need help budgeting your cashflows or finding ways to save cash every month.

2. Debt Management:

The amount of debt you owe and the number of applications for loans you make will decrease your credit score. The banks will see warning signs if you have been applying for a lot of loans in a short period. Borrowing money for home, personal or car loans is not necessarily looked down upon, however ensure you do not overburden yourself with debt, especially in a short period of time as it implies you are heavily reliant on loans.

The Last Resort

Although a poor credit rating will scare away many banks, there are some who are more open to dealing with this type of borrower. ‘Non-Conforming Lenders’ are more open to increased levels of risk, and may still lend to borrowers with a mixed credit history. Note that these lenders will charge increased interest rates or will implement certain loan conditions to account for the increased risk.

Conclusion

If you have a history of late payments, the best thing you can do is implement the above strategies and show consistent performance over a few years. In the long run, this will significantly improve your chances of accessing loans at cheaper interest rates. If you are interested to know your credit score, you can access them often for free from the relevant credit reporting agencies.