Mortgage Brokers – How We Help You

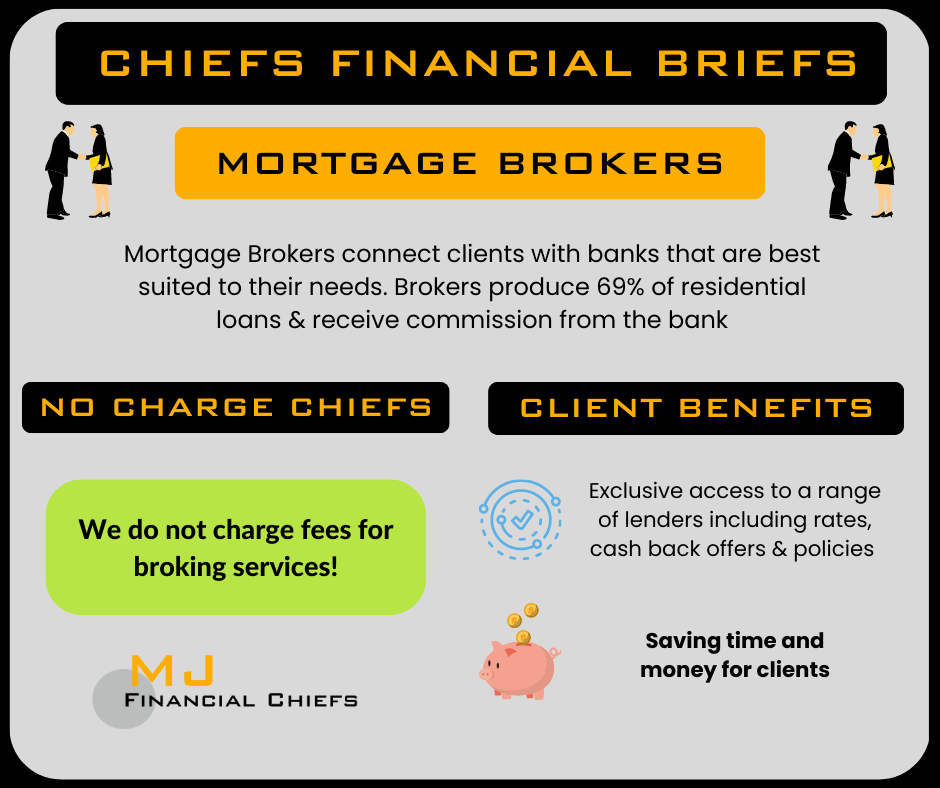

Mortgage Brokers connect people who are looking to borrow money to purchase property or refinance and existing loan, with a bank that is best for them. Simply, brokers provide value to clients by saving them time, money and stress.

This short article explains important aspects of what brokers are, how they create value and where the MJ Financial Chiefs fit into it all!

KEY SERVICES

1. Calculating Borrowing Capacity

Brokers have access to resources and tools that help produce an accurate calculation of a client’s borrowing capacity. Borrowing capacity (maximum loan amount) is the outcome of a client’s income, living expenses and debts. The more a person earns compared to spends, the more they will be able to borrow to purchase a property or refinance.

An accurate borrowing capacity allows the client to narrow their purchase price range and helps them plan for what level of loan repayments they are comfortable with.

2. Recommending The Best Bank

Once the client’s borrowing capacity and financial position have been assessed, brokers have quick access to most of the mortgage market and can single out banks that best meet the needs of the client.

Key factors when recommending a bank:

- Interest Rate

- Maximum Loan Offered

- Credit Policies – Is the bank good with self-employed? Casual workers? Construction loans? Offer places on the First Home Guarantee scheme?

- Customer Service / Turnaround Time.

Generally, the broker will make a professional recommendation to the client of which bank best meets their interests, or the broker will present a shortlist of appropriate banks to the client for them to choose which one they prefer.

3. Handle Loan Applications & Guide Clients Through The Process

Deciding which bank to apply for a loan with is only half the battle. After an application has been lodged, the bank will often ask for additional documents and information which can result in a lot of back and forth before loan approval. After loan approval, the bank, client and solicitors/conveyancers must cooperate to organise the legal transfer of property and the exchange of money at settlement.

Brokers handle all the paperwork and deal directly with the bank which saves the client time, money and reduces the stress of making these important financial decisions.

NO CHARGE CHIEFS – ZERO FEE BROKING SERVICES

We do not charge any fees for our mortgage broking services which improves our value offering to clients. Some brokers charge fees for various reasons which reduces the benefit homeowners receive. Mortgage brokers are paid a commission by banks after settlement as a reward for bringing them the loan that they might not have received otherwise. Commissions are highly regulated and mostly do not change between banks, ensuring brokers do not have any conflicts of interest when working for a client.

The Chiefs are free so please reach out to us to learn about your borrowing capacity, or how much you could save by refinancing. There is no downside!