The RBA Explained

We’ve all been hearing about the ‘RBA’ in the news, but what is it? and why does it impact how much homeowners pay on their mortgage?

The Reserve Bank of Australia (RBA) is Australia’s central bank, meaning that it’s role is to support the Australian economy and financial sector using various strategies and tools. The RBA plays an active role in the economy, intervening in and managing financial markets to achieve its economic objectives (Stable Currency, Full Employment & Economic Prosperity)

RBA IN THE NEWS

The RBA has been in the spotlight over recent years due to its unconventional policy decisions in response to the economic shutdowns of 2020/21. The RBA employed multiple techniques to stimulate the economy by incentivising spending through providing easier and cheaper ways to borrow for banks, businesses and households.

Fast-forward to 2022, the prolonged period of cheap borrowing and high spending, in conjunction with economies struggling to restart from lockdowns resulted in large increases in prices of groceries, fuel, raw materials etc. The RBA since May 2022 has employed policies to slow down spending/inflation in the economy by limiting access to money.

WHAT IS THE CASH-RATE?

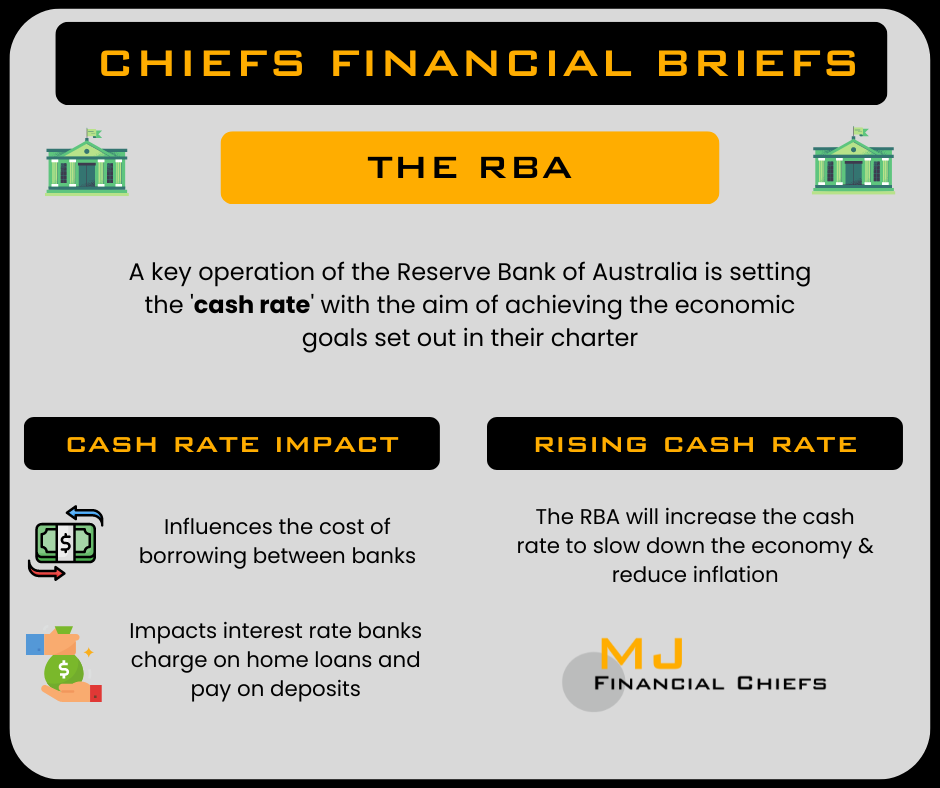

One of the main techniques the RBA uses to slow or stimulate the economy is known as the ‘cash rate’ which determines how much it costs for banks to borrow from each other. The cash rate along with other factors impact the funding costs of commercial banks which individuals use to deposit with and borrow from.

Households are thus affected by the cash rate because a banks’ funding costs determines their lending costs which is the interest rate charged to borrowers on home, personal, and business loans. There are also other factors that influence lending interest rates such as borrower riskiness and competition between banks.

WHY ARE LOAN REPAYMENTS SO HIGH COMPARED TO 2020/21?

The RBA across 2020 and 2021 almost reduced the cash rate to 0% to incentivise borrowing and spending in the economy which helped ensure businesses, households and banks had access to cheap money to cover costs, debts etc. The record low cash-rate meant home buyers could borrow more than usual because interest rates on mortgages were very low at around 2%. The ease of borrowing when purchasing homes contributed to the large rise in property prices over 2021.

Since May 2022, the RBA have increased the cash rate from 0.10% to 3.60% to slow down the economy which has meant banks pay more on money they borrow from each other. This increase in bank funding costs is passed on to households who now also receive higher interest rates on their home loans.

Variable rate loans generally move in-line with cash rate changes which is why variable rate borrowers have experienced a large rise in their loan repayments. Borrowers who fixed their rate have enjoyed protection from the rate rises of 2022/23, however half of all existing fixed rate mortgages are due to expire into variable rate loans in 2023. Loan repayments will become a significantly larger expense to the monthly budget and will cause significant mortgage stress to homeowners who borrowed a large amount in 2021. See below the impact on a borrower’s budget as a result of an expiring fixed rate loan.

Key Points From RBA Forecasts:

- 90% of the fixed rate loans expiring over next two years will experience mortgage repayment increases of at least 30%.

- 25% of fixed rate borrowers will spend more than 30% of their income on mortgage repayments.

- 16% of households are unable to refinance due to not meeting serviceability (application) rules due to higher interest rates compared to 2020/21 when rates were lower and it was easier and cheaper to borrow.

CONCLUSION – HOMEOWNERS SHOULD REFINANCE TO MINIMISE INTEREST COSTS

While the RBA is attempting to achieve its objectives by slowing down the economy, homeowners will have to deal with higher loan repayments and a tighter budget. Although rates are expected to decrease by late 2023/2024, homeowners should be vigilant in making sure they are paying as low interest rate as possible.

Both variable rate homeowners as well as borrowers whose fixed rate is expiring should look into refinancing their home loan to a cheaper interest rate to ensure they are minimising loan repayments. Banks are also offering $2k – $4k cashback payments to customers who switch their mortgage which provides a useful short term incentive.