LVR – Impacting Home Loan Interest Rates & Fees

Firstly, Let’s remove the confusion around ratios. The Loan to Value Ratio (LVR) shows how much a property is being bought with debt (bank loan) compared to cash. Homebuyers should understanding this ratio as it determines how much interest and fees borrowers will pay. Click here to learn about interest.

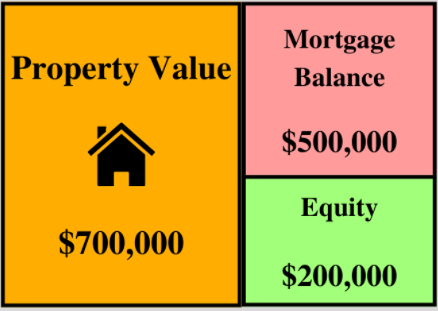

VISUAL EXAMPLE

LVR = Mortgage Balance / Property Value

Above is an example of a property purchased for $700,000 with a $500,000 loan and $200,000 paid from the buyers savings.

In this case, the LVR is 71%, meaning that the $700,000 home was purchased with 71% loaned money and 29% from savings. This means the homebuyer owns 29% of the property at current prices.

What is important to know, especially during a falling property market, is that when property prices decrease, the homebuyer’s ownership (equity) in the property will fall also. This is because the home loan amount only decreases when the homebuyer makes loan repayments.

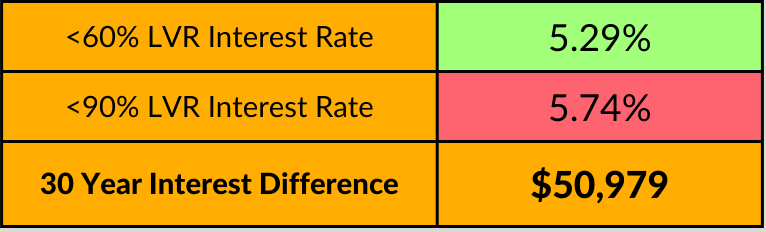

LVR IMPACTS HOW MUCH INTEREST IS CHARGED

The loan to value ratio shows how much of the property the homebuyer owns. Banks use this ratio as a way to measure how risky a homebuyer is.

A homebuyer who owns a majority of the property by paying a large portion of the property price with savings, is considered to be less risky for the bank to lend money to as the bank is less likely to lose money if the property price falls below the loan amount. As a result banks will charge a lower interest rate to lower risk borrowers, however they will charge a higher interest rate for homebuyers with a high LVR (95%)

The interest rates below are a major bank’s interest rates charged at 60% and 90% LVR. As seen, banks charge a higher interest rate to borrowers who own less of the property. The 90% homebuyer will pay an extra $50,979 on a loan of $500,000 over 30 years compared to the 60% LVR homeowner.

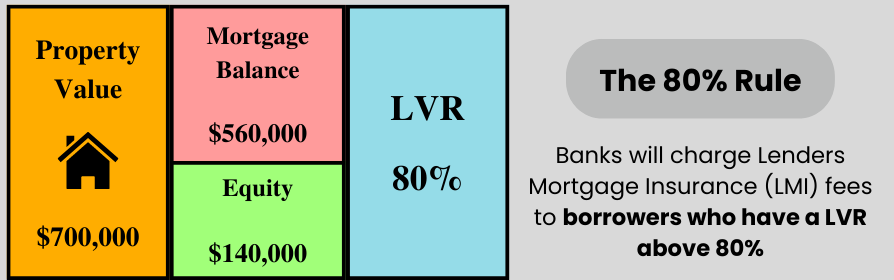

THE 20% EQUITY RULE – EXTRA FEES & THE REFINANCE LIMIT

If a homebuyer purchases property with a LVR higher than 80% (less than 20% equity), lenders charge Lenders Mortgage Insurance fees which is an additional fee charged due to the high risk taken the bank. LMI fees can at times cost $30,000 which is a significant expense for homebuyers when seeking a loan. Homebuyers should generally look to purchase with at least a 20% deposit to avoid paying LMI fees. Click here to learn more about LMI, and how first home buyers can avoid paying it when purchasing with a high LVR.

80% LVR – The Refinancing Threshold

Since interest rates began rising in early 2022, homeowners have been refinancing at a record levels to ensure loan repayments are minimised. The falling property prices has meant homeowner’s equity is decreasing, increasing the LVR closer to 80%. Banks refinancing borrowers who have a LVR higher than 80% will generally charge tens of thousands in LMI fees, which will often remove the incentive for borrowers to refinance. With house prices continuing to fall in 2023, more borrowers will become ‘mortgage prisoners’, stuck with their existing interest rate which may be more expensive than other offers on the market.

CONCLUSION

LVR is a very important concept for borrowers looking to purchase property or refinance as it determines how much interest and fees they will be charged, as well as if they are able to refinance their mortgage to a better rate.