$1,114 Increase In Monthly Loan Repayments in 2023 For Fixed-Rate Borrowers

Summary:

The RBA is expecting over 800,000 households to experience a massive increase in loan repayments as there fixed-rate mortgages expire in 2023. For the average borrower with a $600,000 mortgage who fixed in 2021, loan repayments will increase by $1,114 per month as the interest rate moves from 2% to 5.25%. Borrowers with a $1 million mortgage see their repayments increase by $1,857 to $5,529. To minimise the rising cost of mortgages, homeowners will need to refinance before increasing rates make them ‘mortgage prisoners’.

The Situation

When a borrowing elects to fix their mortgage for 1-5 years, the lender decides the ‘revert rate’ which is the variable interest rate which will apply once the fixed period ends. Over time, this revert rate often becomes uncompetitive and can be much higher than the rates being offered to new customers. Customers often find this lack of loyalty to existing customers highly frustrating.

$370 Billion worth of fixed mortgages will transition to variable rates in 2023 which will see borrowers incur significant increases to their loan repayments compared to the record low rates which they fixed at. The average fixed borrower will experience a 50% increase in loan repayments as their mortgage transitions to variable interest rate in 2023. As a result, the average Melbourne and Sydney household will pay an extra $13,000 each year which represents a large weight on homeowner’s finances.

‘Mortgage Prisoners’

Failing to refinance while interest rates continue to rise could result in the inability to refinance. As property prices are expected to continue falling throughout 2023, homeowners should monitor the value of their mortgage against the value of their home.

80% LVR Rule:

Most lenders will not accept a refinance application if the loan amount is greater than 80% of the property value. Borrowers who are nearing 80% Loan-To-Value Ratio due to falling property prices should contact the Chiefs who will investigate if there are possible savings on the market. If the percentage is getting close to the 80% cut-off, refinancing should be an absolute priority to lock in savings before it’s too late.

Loan Serviceability:

Because rising loan repayments are now taking up a greater proportion of income, borrowers ability to service loans worsens. This can result in other lenders rejecting refinance applications due to the household now having less spare savings and thus present a higher risk compared to 2 years ago.

The Solution

To ensure households are keeping as much income as possible and not losing it to unnecessary interest expenses, borrowers should immediately investigate refinancing to another lender to achieve the lowest interest rate possible.

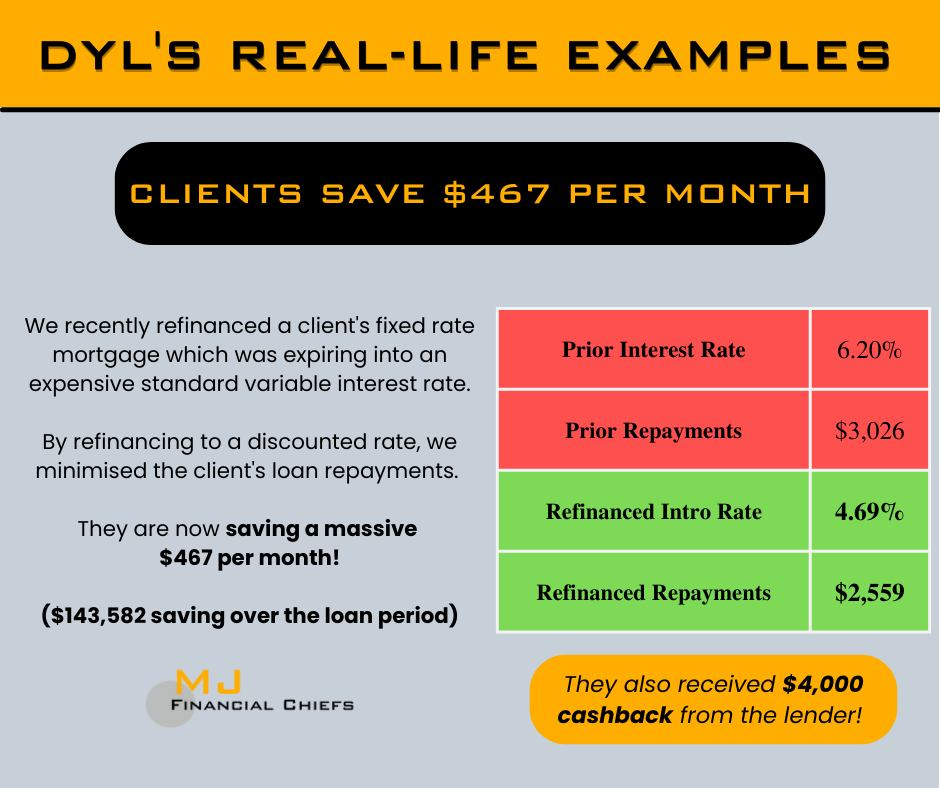

The ‘Chiefs’ have been refinancing client’s expiring fixed rate mortgages which has helped home owners and families save hundreds of dollars every month on their loan repayments. Mortgage Brokers, often without charging you, will quickly find the best available loan for you and handle the full application and settlement process.

Below is a summary of a refinance we completed in which we were proud to save our client $467 per month after refinancing.