Introduction To Interest Rates & Ways To Reduce Interest Expenses

Regarding home loans, interest is basically the cost of money charged to the borrower (homebuyer) in order to compensate the lender. An interest rate is applied to the loan amount which produces a dollar amount of interest that is charged to the borrower. As such, loan repayments made by the borrower will cover the interest charged during the period and a portion of the actual loan amount (principal).

The Long Term Cost of Interest:

As most mortgages have a term of 30 years, interest expenses over the period become very expensive. For example, a $500,000 mortgage that is paid out over 30 years at 5% interest rate will result in $466,279 in interest paid by the borrower. The total cost of the loan is thus $966,279. As seen, interest is a heavy cost to the borrower, however there are several strategies homeowners can utilise to minimise interest costs and keep money in their pocket rather than the banks.

Reducing Interest Expenses:

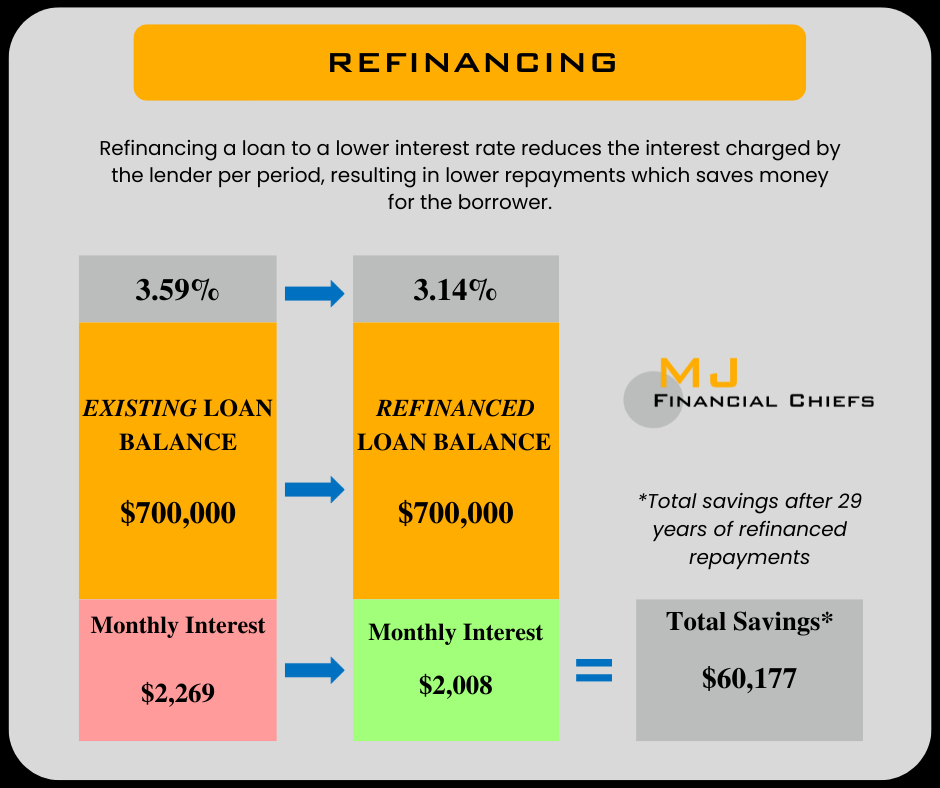

1. Refinancing Your Home Loan

Rising interest rates and expiring fixed rate terms have caused a record level of refinances in 2022 as borrowers seek to minimise loan repayments. As a result, lenders are offering discounted rates to attract new customers which provides borrowers the opportunity to save.

The chiefs have been consistently saving clients money on loan repayments over 2022 by refinancing them to the best loan product on the market. A client of ours is now saving $178 per month after recently refinancing. They also received $4,000 cashback!

2. Make Extra Repayments

Although making extra repayments can be difficult for homeowners with low savings, this strategy is the most effective as the quicker a mortgage is repaid the less interest expenses there are. With a $500,000 loan on a 4.50% interest rate, making $100 extra in loan repayments per month will save the borrower approximately $36,200 over the loan term and will help fully repay the loan 3 years quicker. Click here to learn more about the benefits of making extra repayments….

Offset and Redraw Facilities allow borrowers to use spare savings to reduce interest costs as well as make extra repayments. Click here to learn more.

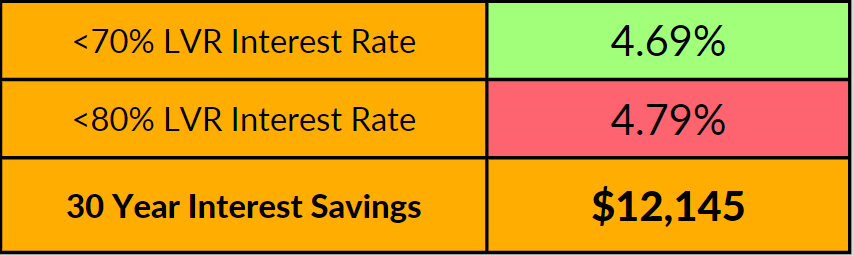

3. Put Down A Higher Deposit When Purchasing

Banks charge lower interest rates to borrowers who use more of their own money when purchasing property as it represents a lower risk to the bank when the buyer has more ‘skin in the game’. As seen below, paying more upfront reduces your Loan to Value Ratio, which saves tens of thousands in interest over the loan term.

4. Utilise First Home Owner Schemes

The Federal Government assists first home buyers with the First Home Guarantee Scheme by removing Lenders Mortgage Insurance fees caused by having a deposit under 20% of the value of the home. Because the government guarantees up to 15% of the loan amount, the first home buyers can apply for loans at an 80% LVR rather than 95% LVR which reduces the interest charged.

Click here to learn more about the First Home Guarantee Scheme.

Conclusion – Refinance, Make Extra Repayments, Higher Deposit & Government Schemes:

In times of high inflation and rising interest rates, borrowers are looking at all the options available to reduce interest costs which are becoming more expensive. The Chiefs can help you keep more money in your pocket rather than in the banks!