Extra Mortgage Repayments – Banks Don’t Want Borrowers To Know This!

As borrowers, we should know all the strategies to save as much money as possible over the loan term. If you have the spare funds, making extra repayments can save a significant amount of money over the loan term.

Understanding Repayment Frequencies

When applying for a home loan, borrowers are able to choose the frequency of their loan repayments. which is generally either monthly, fortnightly or weekly. Choosing to make weekly loan repayments can help slightly reduce interest expenses over the loan term.

The Essentials to Understand About Loan Interest

Firstly, when you have a loan with a bank, there will be an annual interest rate that is attached to your loan. Interest charged to your loan increases the size of a loan balance which represents additional money that has to be repaid. Every day interest is accrued (charged) against the loan balance which means the longer the balance is at a high amount, the more interest that will be added to the loan.

Save Money By Making More Frequent, Slightly Larger Repayments

If the borrower can make extra loan repayments more often, the interest cost over the life of the loan reduces by a significant amount. Less interest means the borrower pays down more of the ‘principal’ loan amount, resulting in the loan being repaid quicker.

An important requirement for these savings to be achieved is by making loan repayments slightly above the minimum amount. Making minimum weekly repayments compared to monthly will not make a significant difference in overall loan cost.

How Much Can Be Saved?

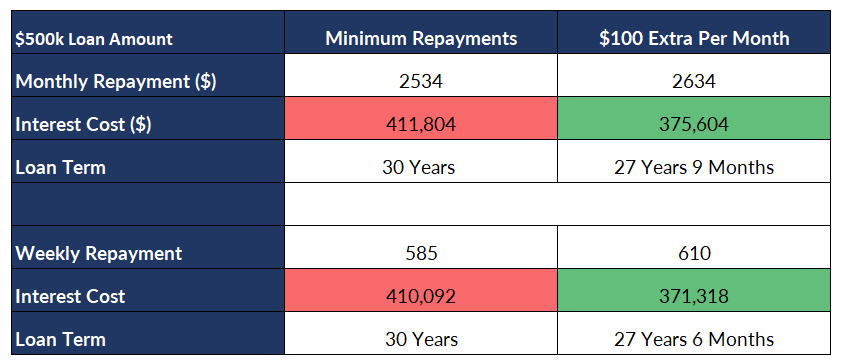

With a $500,000 loan on a 4.50% interest rate, making $100 extra in loan repayments per month will save the borrower approximately $36,200 over the loan term and will help fully repay the loan 3 years quicker. Making weekly extra repayments brings the savings to $38,774 and cuts an extra 3 months off the loan term.

Conclusion – Utilise Spare Savings!

Banks make a significant amount of money from interest over a 30 year mortgage. As interest rates are rising, it is especially important for borrowers to repay loans as soon as possible to minimise interest expenses. As seen above, by making $100 extra repayments every month, you can save almost $40,000 that you normally would have been paying when making minimum repayments.

Your loan product will usually come with a Redraw Facility which allows you to make extra repayments on your home loan. You can redraw these additional payments if you ever need access to quick cash, however it is important to understand the lender conditions as there may be small charges for redrawing. Click here to learn more about Redraw Facilities.