The Big Decision – Variable v Fixed Interest Home Loans

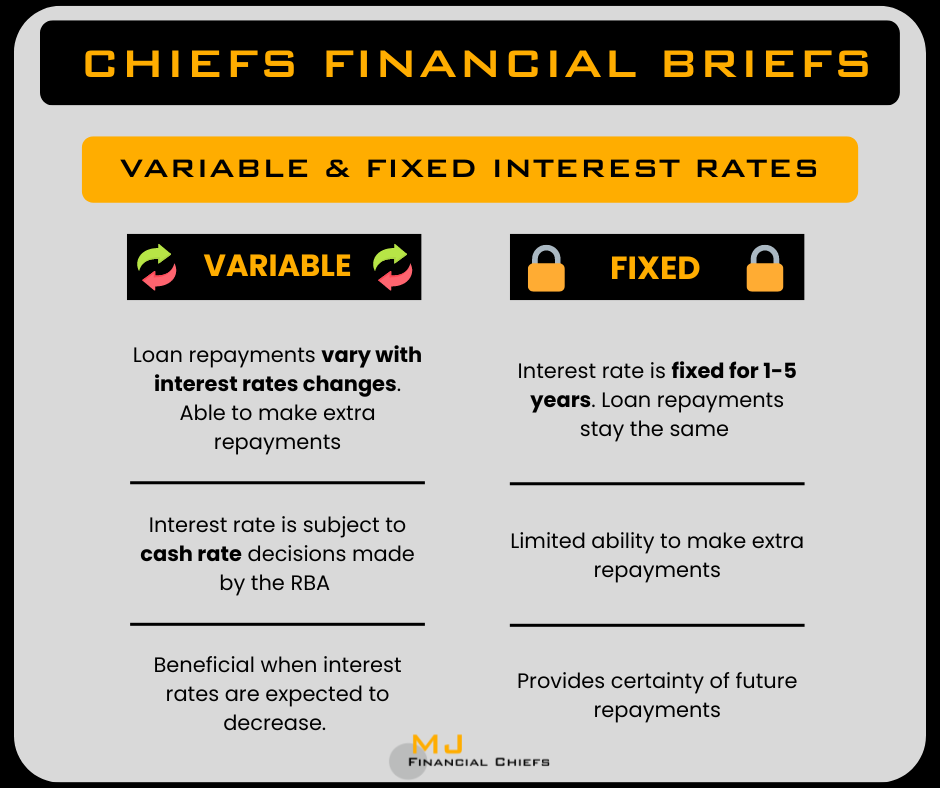

When assisting our clients through the process of purchasing a home, a question we often receive is; “Should we fix our interest rate or go for a variable rate?” Although there is never a clear winner between variable and fixed, the correct decision is always determined by the client’s situation and requirements, as well as the current and expected economic environment.

VARIABLE INTEREST RATE – THE BASICS

A ‘Variable’ interest rate home loan means that the amount of interest charged to the borrower every period can change depending on bank policies and cash rate decisions made by the Reserve Bank of Australia. As a result, if interest rates decrease, the amount of interest charged to the borrower also decreases. This results in loan repayments falling and money being saved for the borrower.

The opposite occurs if interest rates increase. More interest is charged causing minimum loan repayments to increase to account for the additional interest which is now building up on the loan amount.

FIXED INTEREST RATE – THE BASICS

A Fixed Interest Rate home loan means the amount of interest charged to the borrower will remain unchanged over the fixed period, resulting in ‘locked in’ loan repayments that will not adjust. Typically, the borrower can choose a fixed period between one and five years. Fixed rates vary across these periods depending on future expectations.

There are high break fees charged if the borrower refinances or changes the loan during the fixed period. Depending on the lender’s policy, the borrower may be able to make limited extra repayments or they may not be able to make any extra repayments.

REASONS TO CHOOSE A VARIABLE INTEREST RATE

1. Ability to Make Unrestricted Additional Repayments.

Almost all variable rate home loans include a redraw facility which allows the borrower to make extra repayments above the minimum requirements. These extra payments can then be ‘redrawn’ if the borrower needs access to cash.

Making consistent extra repayments through the redraw facility reduces interest expenses will save the borrower tens of thousands over the life of the loan. Click here to learn more.

Because making additional repayments are either restricted or prevented during fixed interest rate periods, interest savings are maximised when on a variable rate home loan.

Lenders have different conditions around redraw facilities which the borrower should be aware of. For example, some lenders charge the borrower when they redraw extra repayments back out of the loan. There may also be a limit on how much can be redrawn each day. Your broker is able to outline each bank’s policy regarding redraw facilities.

2. Interest Rates Are Expected To Fall In The Future.

Over 2022, interest rate rises have been caused by central bank efforts to slow down the economy in order to reduce the high inflation levels. This has seen loan repayments of variable rate borrowers increase significantly from the historic low levels of 2020/21.

Although a fixed rate loan may seem more appealing after these changes, banks have increased fixed rates to expensive levels which then means interest rates must continue rising significantly for the fixed rates to produce material savings for the borrower. This has seen variable rate loans become the majority in 2022, with over 90% of new mortgages being variable by July 2022.

Interest rates are expected to continue increasing into early 2023, there are developing expectations of an economic slowdown by late 2023 which should halt and possibly reverse the recent interest rate rises, which variable rate borrowers should benefit from. However, expectations of the economy and interest rates are limited by unexpected factors that will occur in the future. As such it is hard to guarantee savings by choosing a variable rate loan today compared to a fixed rate term.

REASONS TO CHOOSE A FIXED INTEREST RATE

1. Interest Rates Are Expected To Increase Above Fixed Rate Prices.

A key benefit of fixing the interest rate is being insulated from interest rate rises which impacts variable rate borrowers. For example, if a borrower fixed a mortgage for 2 years in 2021, their loan repayments would remain the same and not be affected by the significant interest rate rises of 2022.

It is important to note that it is often very difficult to predict what interest rates will be in the future. The general consensus currently is that interest rates will continue to increase into early 2023 with a halting or even decrease of rates later in 2023 due to an expected economic slowdown and decreasing inflation. As mentioned for variable rate loans, the uncertainty of future interest rates means it is hard to guarantee savings by fixing now to avoid future high rates.

2. The Ability To Budget Into The Future & Lower Risk of Mortgage Stress

Because fixed rate loans will lock in a certain loan repayment over the fixed term (1-5 years), the borrower is able to budget their cashflows more accurately over this period as they know exactly what they will be paying toward the loan. A fixed interest rate eliminates worrying about rising interest rates and thus provides peace of mind that loan outgoings are known and expected. This allows for simpler cashflow budgeting of household expenses, helping the borrower plan out their savings.

Fixed rate loans can also reduce the risk of ‘mortgage stress’ which essentially occurs when a large portion of a borrowers income goes toward their loan repayments. Applying for a fixed rate means the bank calculates borrowing capacity based off the known loan repayments over the fixed term. Banks include a safety net when determining how much a person can borrow to account for any unexpected decreases in income or increases in expenses which would make repaying the loan more difficult.

Because fixed loans lock in an interest rate, there is no danger of interest rates and loan repayments increasing over the term, which then results in ‘mortgage stress’ on variable rate borrowers who would be making higher repayments.

Conclusion: The 3 Main Factors

1. Your Situation

2. Your Preferences

3. Economic Expectations

The decision to keep your mortgage fixed or variable will depend on your financial situation, how much you value peace of mind and importantly future economic expectations as this will determine the price of fixed rate loans.

If you are unsure about how to navigate this complex decision, reach out to the Chiefs as we’re more than happy to assist you through this process by learning more about your goals and objectives as well as discuss our opinions on current and future interest rates.