Mortgage Refinancing – The Saviour of Borrowers in 2022

At MJ Financial Chiefs, we offer competitive mortgage refinancing rates to help you save money on your home loan. Contact us today to learn more about our refinancing options

The Situation.

Mortgage Refinancing Rates… It’s been the hot topic of the housing market as rising interest rates and inflationary pressures lower consumer confidence to levels last seen during the Global Financial Crisis.

Since the RBA began rising the cash rate in April, mortgage holders have rushed to refinance to minimise their increasing loan repayments. Home buyers who took advantage of low fixed rates during 2020 and 2021 are facing significant rises to their interest rates once the fixed term expires.

The important questions everyday home owners are asking are – “What is refinancing? And “why is it a strategy to reduce loan repayments?”

What is Refinancing? Understanding Mortgage Refinancing Rates.

Essentially, refinancing is the process of securing a new home loan with different features and a lower interest rate. The new mortgage replaces the existing home loan by paying the lender out. Loan repayments are now sent to the new bank.

A Strategy to Reduce Loan Repayments.

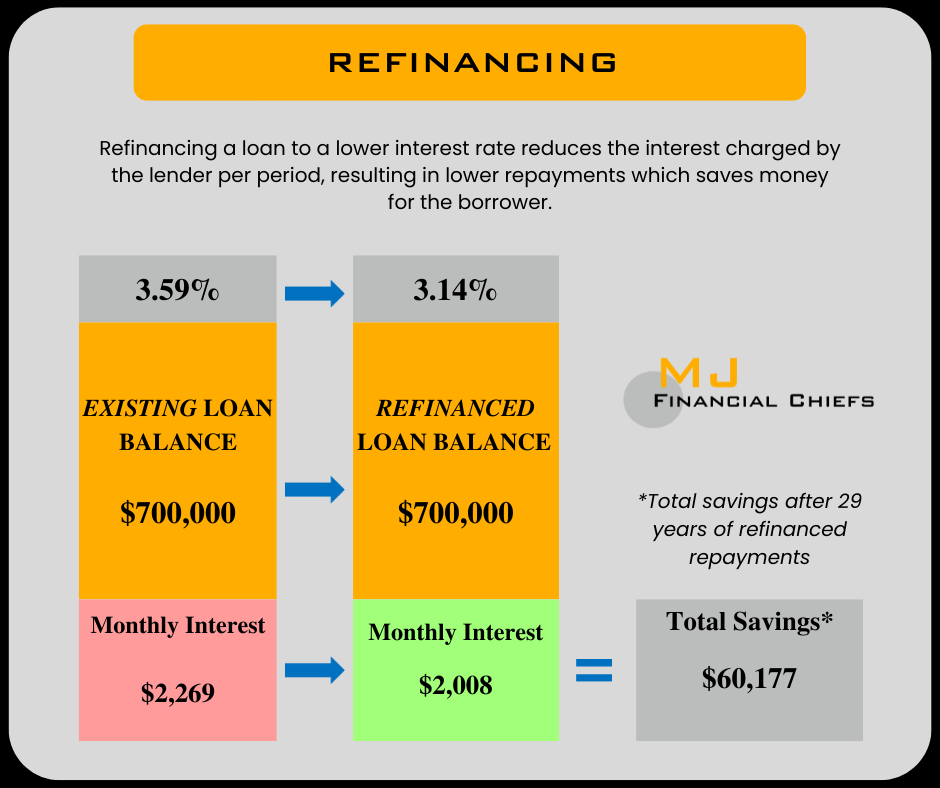

By moving to a lower rate , the bank charges less interest on the outstanding loan balance, resulting in lower repayments required by the borrower, saving the household money over the life of the loan.

As interest rates and the cost of living have risen over 2022, home owners have rushed to refinance their home loan in order to save. As rates are forecast to continue rising into 2023, there will continue to be opportunities for borrowers to find cheap loans as banks compete on pricing to attract customers.

The figure below shows how refinancing to a lower interest rate saves money for the borrower;

Special Features & Options When Refinancing

- Cash-Out Refinancing

As loan repayments are made over several years, the ‘debt’ portion of the home value decreases while the ‘equity’ stake of the home owner rises.

If the home owner needs cash for renovations, new property purchase etc, they can ‘access equity’ in the property by increasing the loan amount (borrow more), and receive the increased amount in cash. Banks allow ‘cash-out’ refinances as the borrower has a history of making repayments and own a greater amount of the property, which reduces the risk to the bank when providing the loan increase.

- Refinancing With An Offset Account:

Offset accounts are bank accounts where the money inside reduces the amount of interest charged on the loan amount every period. The greater the amount of cash in the account, the less ‘principal’ there is for the bank to charge interest on.

Because mortgages that include offset accounts charge more interest compared to ‘basic’ mortgages, many younger home owners go with basic loans to save money. Over several years, these borrowers can start thinking about offset accounts as they usually have built up spare savings after receiving pay-rises. Refinancing to a mortgage with an offset account will allow the household to utilise spare savings to reduce interest charges which minimises loan repayments.

Click here to learn more about offset and redraw accounts.

Conclusion – ‘contact your broker to see if money can be saved by refinancing’

Refinancing has been a necessary strategy for many households this year to minimise loan repayments and save money. Refinancing is a relatively simple process which your mortgage broker can guide you through to determine if there are savings up for grabs!

To gain some more information regarding refinancing visit Australian Securities and Investments Commission (ASIC) website. This website provides you with helpful advice on refinancing your home loan, including the legal requirements and consequences, as well as tips on how to reduce costs.

#MortgageBrokerMelbourne